Energy storage is the real game changer in Greece – PV Tech

I believe there are two main reasons for that: First, a bottleneck in grid connection offers. IPTO, the Greek TSO, is planning to offer connection terms for 28-30 GW of RES by 2030. Some 20 GW of them will be for PV. Yet, there are over 70 GW of PV applications competing. Not everyone will get the desired connection terms, and this creates uneasiness in the market. True, but who needs all these projects? On the other hand, this is the case all over the world.

A second reason for worries is that 2023 was the first year with some curtailments for PV (228 GWh). This year we expect curtailments to quadruple. For shortsighted investors, this sounds like an Armageddon. On an annual basis the level of curtailments will be in the order of 4%-5%. During sunny days, PV contributes over 60%-70% of energy during midday. Considering that there is no storage available yet in Greece, it is only reasonable that we have these levels of curtailments. The first utility-scale batteries will become operational in 2026, and curtailments are expected to ease. The National Energy and Climate Plan (NECP), however, foresees only 3.1 GW of BESS until 2030. This is not enough to keep curtailments at reasonable levels. We would need anything from 5 to 8 GW of storage to resolve the issue of curtailments.

The last draft of NECP (which is currently amended) also foresees 13.4 GW of PV until 2030. We expect the actual market to be over 16 GW by that time.

For almost 15 years, the Greek market was dominated by small and medium size ground-mounted systems, supported by feed-in-tariffs and feed-in-premiums. Now, a lot of large-scale projects have matured, and we expect them to take over with regard to overall installed capacity.

The self-consumption market is also increasing. The relevant market segment doubles in size every year and we expect it to be vibrant during the next years. Just recently (April 2024), the Greek government has abolished the existing net-metering scheme for prosumers and established a net-billing scheme instead, raising a lot of concern among small-sized installers.

When in doubt, always look at the fundamentals. Always look at the big picture. Hear are some data that show the real world. These figures do not lie.

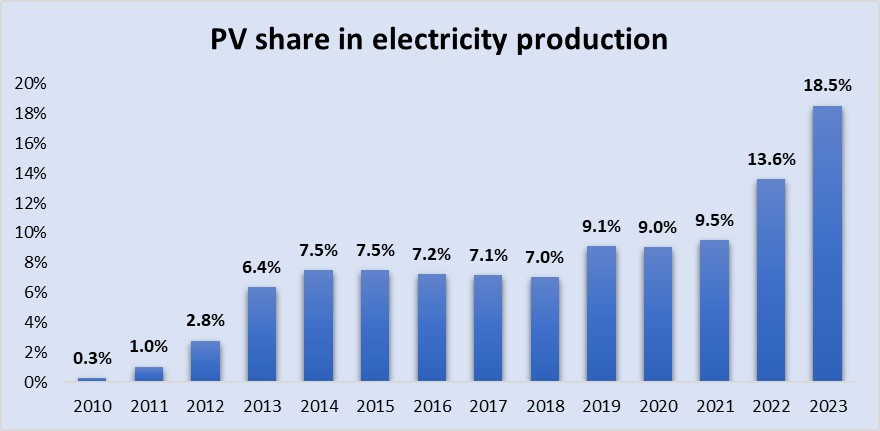

In 2023, Greece ranked first in Europe in terms of the percentage of domestic electricity produced by photovoltaics (PV), with a percentage more than double the European average (8.6%) and more than three times the global average (5.4%).

Thanks to solar PV, the release of 5.7 million tons of carbon dioxide CO2 was prevented in 2023. This is the amount of CO2 emitted by 4.6 million new cars with internal combustion engines that each drive an average of 10,000 kilometres per year. The environmental benefit is equivalent to planting 147.6 million conifers or 90.1 million deciduous trees and letting them grow for a decade.

In 2023 alone, €1.12 billion (US$1.19 billion) were invested in new solar PV projects in Greece. This growth was accompanied by 15,840 full-time equivalent job positions.

Stelios Psomas is a policy advisor at Greek trade association Hellenic Association of PV Companies (HELAPCO) and will be one of the speakers at PV Tech publisher Solar Media’s upcoming Large Scale Solar Southern Europe event in Athens, Greece. Returning for a second year, the event will be held during 2-3 July 2024. The event will focus on an ever-growing market such as Southern Europe with a packed programme of panels, presentations and fireside chats from industry leaders responsible for the build-out of solar PV projects in Greece, Turkey and Croatia. More information about the event, including how to attend, can be read here.